Publishers are flocking to affiliate marketing despite the coronavirus wreaking havoc on retailers’ advertising plans.

New data from Awin shows approved affiliate applications to the global network have more than doubled since the lockdown took effect in many countries. Kicking in around mid-March, total applications spiked 80% before accelerating further in April. The situation was further compounded by Amazon’s announcements that it was removing a raft of longstanding publishers from its Associates’ programme.

That decision was then followed up by the news that Amazon commissions would be slashed across its entire programme by up to 80%, leading to Awin applications seeing a sharp increase of 150% on January and February’s average.

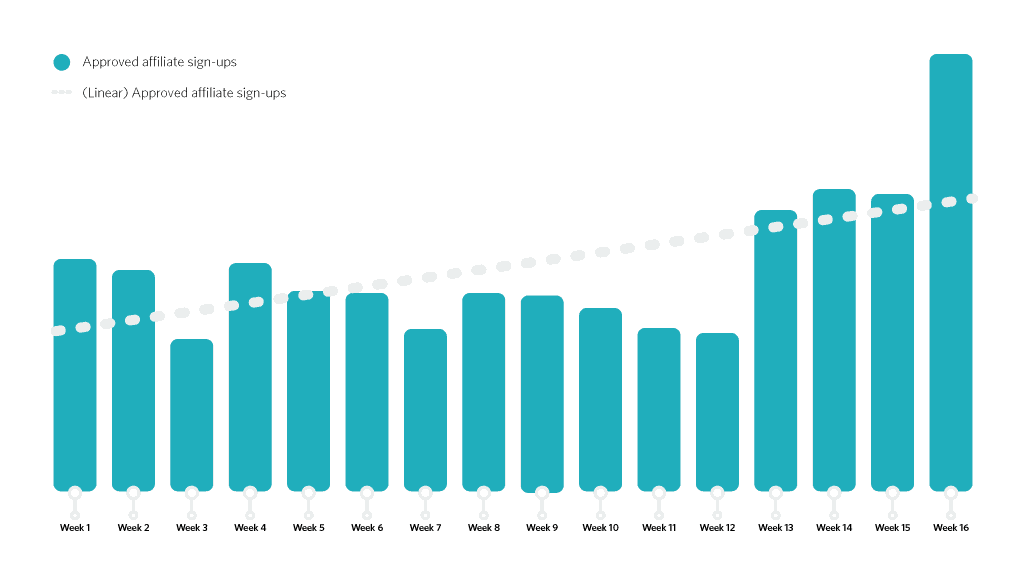

Awin assessed every approved affiliate application across all territories from January 1st to April 21st. Segmenting the data on a weekly basis, the upward trend across March then ramped up in mid-April (week 16):

The coronavirus has decimated marketing spend across the world. According to a recent survey of 400 businesses by IAB US, 74% feel the pandemic will have a bigger impact than the financial crisis of 2008, with seven in ten pausing or adjusting their planned spend. One in four have halted all advertising until the end of June and, while traditionally resilient, digital ad spend is down 33%.

Affiliate marketing hasn’t escaped unscathed, with high profile brands like Macy’s suspending their affiliate programmes. Despite some notable exceptions, especially in the travel sector, Awin is running more than 95% of its retailer campaigns as normal, presenting publishers with an opportunity to plug revenue gaps they may be experiencing through other channels.

Global commissions in April are running 25% higher than the same period in 2019 as consumers turn to ecommerce, with sales in certain verticals such as beauty and homeware doubling at certain times, offering a positive story for publishers of all varieties.

Digital services are experiencing unprecedented demand. Despite UK retail suffering a general 5% slump in March, The Office for National Statistics said 22% of all sales were driven by ecommerce, the highest it’s ever been and a figure that could hit one in four pounds spent online in April.

Meanwhile many publishers are facing shortfalls in anticipated revenue as keyword blocking of coronavirus related terms is leading to ad units being blocked online. With some of these sites also dependent on Amazon’s Associates programme for income, affiliate marketing’s focus on performance is proving an attractive option for publishers and brands alike.

As Amazon’s commission changes are currently limited to the US, the biggest uplift in affiliate applications has been witnessed across Awin US and ShareASale. From mid-March to the middle of April, publishers have flocked to the networks, the team processing almost four times as many approvals in the second half of April:

Similarly the application to approval rate on the network has improved significantly to almost 60% as established affiliates register their interest in alternative promotional sources, thus underlining the revenue opportunity for brands.

But it is not enough to just expect affiliates to switch from one platform to another. The Amazon Associates’ programme is one that thousands of affiliates are familiar with and have been using for years. By contrast they may find other programmes and network interfaces alien to them and additional guidance will be necessary.

To support publishers affected by Amazon’s changes, it is imperative networks and SaaS platforms make access to their technology and advertisers as seamless as possible. Awin has expedited applications from publishers new to the network, ensuring they will be processed within one business day, as well as speeding up application times to individual advertiser programmes.

The current pandemic and decisions to pause programmes or slash commissions from major campaigns represents the biggest upheaval seen in the channel since Google exited the affiliate space in 2013. The difference now is affiliate marketing is firmly part of the mainstream marketing mix in a period of pent-up consumer demand. The industry’s pure payment on performance heritage and the continued commitment from the overwhelming number of advertisers operating affiliate programmes demonstrates the resilience of the channel in these turbulent times.

The post Affiliate Marketing Demand Soars as Budget Cuts Kick In appeared first on PerformanceIN.